Author(s): Olumide Obasemo

Affiliated Institution: Startup Grind

Type of Publication: Article

Publication Date: January 2015

IrokoTV, dubbed ‘Netflix of Africa’ and that has closed several funding rounds in excess of US$30m, started in 2010. Thanks to a Series A VC investment of $3M from US-based hedge fund Tiger Global, it is now the world’s largest online platform for African entertainment, one of the most recognised and well-respected African technology brands, “one of Nigeria’s most well-funded companies” and is at the heart of Africa’s exciting tech space.

Jobberman started in a Nigerian University dorm in 2009 and has grown into one of Sub-Saharan Africa’s most popular job search engines with more than 1.5million visitors monthly andone of the companies in Nigeria’s tech space enjoying VC backing. It was 100% acquired last month by the $167million-valued One Africa Media, a portfolio of online marketplaces that is 30%-owned by SEEK – the world’s largest online employment marketplace by market capitalization.

Supermart was started last year to allow help customers shop online for groceries from leading brick-and-mortar supermarkets as well as the local market, thereby avoiding the notorious Lagos traffic. It has now become Nigeria’s largest online supermarket and grocery delivery service as a result of its convenient service offerings and the investment from iYa Ventures, a North-America based venture capital firm that invests in technology companies in Africa.

These are just a few leading examples of the multitude of growingly successful tech startups in Lagos, the economic capital of Nigeria, the country with the largest economy and population in Africa, from which increasing number of tech VCs is deriving deepening value, robust ROI and strong social impact; thus corroborating all the global newsfeed about Africa Rising as not just a PR stunt!

Andela was also founded last year and has obtained $3million so far in seed funding. It is backed by investors including Steve Case, Omidyar Network, Founder Collective, Rothenberg Ventures, Learn Capital, Melo7 Tech Partners, and Chris Hughes. Using its Lagos-based ‘campus’ and New-York office, Andela’s mission is to “find the brightest young people in Africa and give them the rigorous training and mentorship needed to thrive as full-time, remote developers for companies around the world”.

Hotels.ng started in Q4-2012 as “a small scrappy startup tech firm” and, with blood, sweat and tears, has now been transformed into the biggest online hotel booking agency in Nigeria (with an estimated 170million population), using seed investment of $225k from SPARK in 2013. A few days ago, it became another beacon of success in Lagos tech space with the announcement of its Series A round of $1.2m funding from EchoVC Pan-Africa Fund, a seed-stage technology fund, and Omidyar Network.

These are just a few leading examples of the multitude of growingly successful tech startups in Lagos, the economic capital of Nigeria, the country with the largest economy and population in Africa, from which increasing number of tech VCs is deriving deepening value, robust ROI and strong social impact; thus corroborating all the global newsfeed about Africa Rising as not just a PR stunt!

So, given the foregoing, how can investors looking to achieve greater ROI and/or social impact partake of Africa’s Silicon Valley? Or, the flip side: how do you ensure that hard-earned capital doesn’t get swallowed by those challenges highlighted in the CNN “survey”?

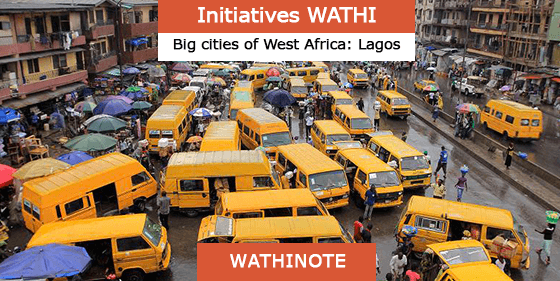

However, it isn’t plug-and-play for investors willing to have a slice of prosperity in Lagos (undisputedly, Africa’s Silicon Valley, because it possesses most, if not all, of the same attributes of “the fifteen-hundred- square-mile shelf an hour south of San Francisco” in the US). This is a city like no other: full of paradoxes. CNN recently crowdsourced opinions on Twitter, using the hashtag #CNNLagos, “to get a lay of the startup landscape [in Lagos]” and the summary would make you equally laugh and sober at how resilient and witty the entrepreneurial spirit need to be in order to thrive herein, despite unimaginable man-made challenges.

Putting these examples (and several others known to be on the path to success) side-by-side with the challenges in that CNN “survey” brings to my mind one of Albert Camus’ quotes on the beautiful paradoxes of life; but more importantly, it aptly describes the general entrepreneurial spirit in the startup community in Nigeria: “In the midst of winter, I found there was, within me, an invincible summer. And that makes me happy. For it says that no matter how hard the world pushes against me, within me, there’s something stronger—something better, pushing right back.” There is an uncommon tenacity among startups here; but that in itself alone still won’t make you place a wager on them!

So, given the foregoing, how can investors looking to achieve greater ROI and/or social impact partake of Africa’s Silicon Valley? Or, the flip side: how do you ensure that hard-earned capital doesn’t get swallowed by those challenges highlighted in the CNN “survey”?

There is no hard-and-fast answer to these make-or-mar questions that burn on the mind of investors playing in the startup space, but from my somewhat-diverse past experience of providing financial services to businesses in Nigeria and current experience of starting and managing my own business in Lagos as well as from my interactions with other entrepreneurs and stakeholders therein, I want to lay out some pointers on finding and backing potential winners:

Strong background blended with requisite characteristics: A peep into the background of the founders/teams behind all the Nigerian startup examples mentioned above would reveal that they all had strong and diverse academic/work background as well as the requisite traits with which to nurture world-class startup firms and adapt to overcome local challenges.

Jason and Bastian of IrokoTV have a uniquely superb blend of street and formal education as well as the infinitely elastic attitude to build a successful pioneer-status startup business order out of a developing-economy chaos. Mark Essien of Hotels.ng is an engineer at heart and arguably one of the most impressive Nigerian technology entrepreneurs. After his bachelor’s and postgraduate Computer Science education in Germany, he built software products and companies that have been bought by large companies in Europe and the US such as Walt Disney and the US military.

Formidable partnerships: Given the myriad of global and local challenges to overcome in order to have a chance for the business to survive and thrive, it is absolutely critical that startups looking to attract investment have formidable partnerships either already established or at an advanced stage of establishing them. This further lends credence to the need for strong background which would naturally provide the personal and professional networks that startups can tap for resources and solutions to gain traction, market share, human capital, etc, towards overcoming all the peculiar local hurdles hell-bent on consuming startups.

The founders of Supermarket.ng were directors involved in the operations, from inception in 2012, of Jumia Nigeria – Nigeria’s no. 1 online retailer backed by Rocket Internet GmbH, the world’s largest internet startup conglomerate. This experience, among others, along with their rigorous academic education, provided significantly vital resources and supply chain network to build Supermarket.ng

One of the undeniable deductions from that CNN “survey”, although unscientific in form, is that, while startup life is really, really hard world over, it is definitely much harder in Lagos [perhaps, as well in most other emerging markets]

Rapid & Aggressive Scalability: Nigerian/African startups would hardly command millions of dollars in valuation at inception; nor would they have the usual Western-style transaction size that fits into the typical investors’ fund, with limited timeline. So, global investors that will succeed here in Africa’s Silicon Valley would have the patience and long-term value mindset to nurture a strong startup potential with seed funding of between $300k & $2m into one with multiple-$100m funding in 1-3years.

DDD (Detailed Due Diligence): In most African countries, there’s no Social Security Number nor is there a quick identification search process; so Due Diligence (DD) as it is known and taught is never going to be sufficient to closing viable investment deals; hence, the idea of DDD. I particularly find the approaches of these two companies (Ingressive and RENEW Strategies) very useful in this regard as an entry platform into Nigeria and other African countries; otherwise, a highly trusted referral would do.

One of the undeniable deductions from that CNN “survey”, although unscientific in form, is that, while startup life is really, really hard world over, it is definitely much harder in Lagos [perhaps, as well in most other emerging markets]. The risk probability of a typical Nigerian startup thus theoretically looks like only yielding negative return for investors’ capital. Whilst this deduction could be true and graveyard failure examples (the subject of a future post) abound to corroborate it, another deduction weaved into the preponderance of these opinions sampled by CNN is that “the potential is endless – that the opportunity is buried in the chaos!”

The above pointers along with global startup investment best practices would help position investors to finding those viable investment opportunities in developing African countries, especially Lagos, the continent’s Silicon Valley.

Les Wathinotes sont soit des résumés de publications sélectionnées par WATHI, conformes aux résumés originaux, soit des versions modifiées des résumés originaux, soit des extraits choisis par WATHI compte tenu de leur pertinence par rapport au thème du Débat. Lorsque les publications et leurs résumés ne sont disponibles qu’en français ou en anglais, WATHI se charge de la traduction des extraits choisis dans l’autre langue. Toutes les Wathinotes renvoient aux publications originales et intégrales qui ne sont pas hébergées par le site de WATHI, et sont destinées à promouvoir la lecture de ces documents, fruit du travail de recherche d’universitaires et d’experts.

The Wathinotes are either original abstracts of publications selected by WATHI, modified original summaries or publication quotes selected for their relevance for the theme of the Debate. When publications and abstracts are only available either in French or in English, the translation is done by WATHI. All the Wathinotes link to the original and integral publications that are not hosted on the WATHI website. WATHI participates to the promotion of these documents that have been written by university professors and experts.