Authors : Sheila Leatherman and Christopher Dunford

Type of publication : Academic article

Publication date : June 2010

At the forefront of global health priorities are the achievement of the United Na-tions’ Millennium Development Goals (MDGs) and the strengthening of health systems. The MDGs focus the worldwide development agenda on reducing extreme poverty as well as improving health, education and human rights by 2015. At the same time, the World Health Organization is emphasizing the need to build health-system capacity, a global challenge that is most elusive in rural and resource-poor environments. Meeting global health needs calls for more inter¬sectoral approaches. One that holds real promise, though largely underutilized, is the linking of microfinance with appro¬priate health-related services.

Microfinance institutions and health

More than 3500 microfinance institutions around the world provide credit and other financial services to more than 155 million households in support of income generation and consumption. According to conservative estimates from United States Agency for International Development (USAID) studies, at least 34 million of these households are very poor, representing 170 million people, many of whom live in remote areas beyond the reach of health agencies, both private and government.

Every day, thousands of microfinance workers travel to poor communities to provide microfinance services, often to groups of women convening on a regular basis over months and years to repay loans and deposit savings. Many microfinance institutions in Africa, Asia and Latin America already successfully offer services beyond microfinance, including training in business and financial management.

An increasing number also offer health-related services, such as education, clinical care, health financing (loans, savings and health insurance) and establishing linkages to public and private health providers to facilitate access to health care. This is a vast, private-sector infrastructure of service delivery that is mostly self-financed by interest on loans.

Why would microfinance institutions expand their services to include health? There are two basic reasons: health services are a natural extension of their mission of financial security and social protection of the client [as illness is frequently identifies as one important cause of a downward slide into poverty], and healthier clients better serve the microfinance institutions’ goals of growth and long-term viability. Clients are not the only beneficiary; when a family member is ill, this affects productivity. Thus access to health-related programmes and services generally includes the household, not just the client.

Establishing linkages to public and private health providers to facilitate access to health care

Evidence of impact

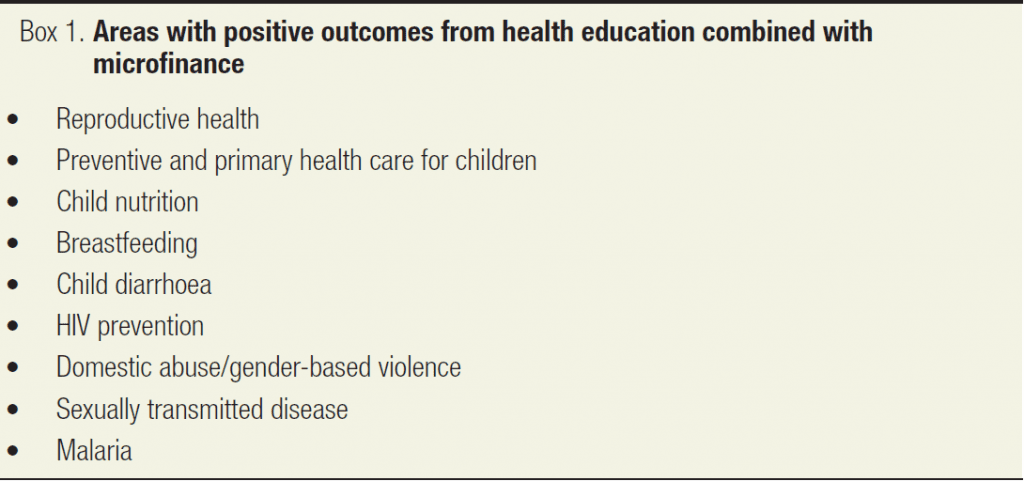

Studies of microfinance institutions delivering health-related services show increasing evidence of positive impact. Multiple studies show that adding health education alone, usually delivered during the routinely scheduled microfinance group meetings, improves knowledge that leads to behavioural change. These behaviours are associated with positive health outcomes in diverse areas that are critically important to achieving the MDGs, such as maternal and child health, and infectious disease (Box 1).

Beyond the potential contributions to disease and mortality reduction [through health education programmes liked to micro finance institutions], microfinance can strengthen health systems. This capacity-building ranges from national initiatives to targeted local strategies. Perhaps the best illustration of how microfinance and health programmes strengthen national capacity is in Bangladesh. There, institutions such as BRAC (Bangladesh Rural Advancement Committee) have launched integrated programmes over the past three decades to combat poverty by combining health, education and credit services, including partnering with the national government for large-scale tuberculosis- and malaria-control initiatives.

Conclusion

Single solutions are not enough to solve the prevalent and persistent problems of infectious disease, high maternal and infant death rates, and the rising incidence of chronic illness. Poor populations need access to a coordinated set of financial and health services to have income security and better health.

Microfinance institutions have already shown themselves capable of contributing to improving health-care capacity and health outcomes by educating clients, facilitating access to public and private providers, making referrals to higher levels of skill and resources, providing health financing options (such as loans, savings and micro insurance) and even directly delivering clinical care.

Worldwide, health systems are proving to be inadequate at meeting population needs. The global health community could broaden its contribution to achievement of the MDGs and strengthening of health systems worldwide through intersectoral programming that utilizes a microfinance platform to reach poor and underserved populations.

Les Wathinotes sont soit des résumés de publications sélectionnées par WATHI, conformes aux résumés originaux, soit des versions modifiées des résumés originaux, soit des extraits choisis par WATHI compte tenu de leur pertinence par rapport au thème du Débat. Lorsque les publications et leurs résumés ne sont disponibles qu’en français ou en anglais, WATHI se charge de la traduction des extraits choisis dans l’autre langue. Toutes les Wathinotes renvoient aux publications originales et intégrales qui ne sont pas hébergées par le site de WATHI, et sont destinées à promouvoir la lecture de ces documents, fruit du travail de recherche d’universitaires et d’experts.

The Wathinotes are either original abstracts of publications selected by WATHI, modified original summaries or publication quotes selected for their relevance for the theme of the Debate. When publications and abstracts are only available either in French or in English, the translation is done by WATHI. All the Wathinotes link to the original and integral publications that are not hosted on the WATHI website. WATHI participates to the promotion of these documents that have been written by university professors and experts.